Buyer-Focused Solutions

With a sharp focus on buy-side-related touchpoints, our team understands serial acquirers. We turn pain points into non-issues. Led by industry veterans with decades of buy-side expertise, our team includes former M&A attorneys and seasoned, money-center bankers who approach every deal with a combined focus on relationship and technology.

We’ve built buyer-focused solutions that boost continuity, efficiency and trust throughout the transaction life cycle — including post-closing activities. Our dedicated support team helps your diligence move quickly: We guide you through the clear and simple Know Your Customer (KYC) process, open accounts within one business day and accommodate your preferred agreement templates on your timeline.

Solutions for Your External Counsel

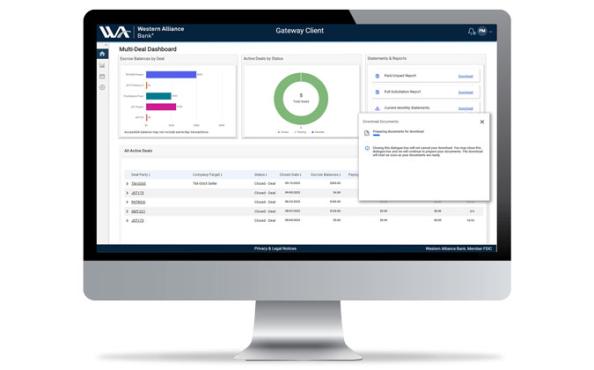

We launched Gateway Counsel, the first digital solution of its kind, designed specifically to assist your external counsel in supporting you throughout your transaction. Your legal teams gain real-time access to solicitation tracking, payment status account balances and key transaction timelines — all in one centralized platform.

Solutions for Your Treasury Team

- Streamlined flow of funds

- Full reporting access across all deals

- Easy access to year-end data for auditors — no need to chase your agent

- One-click view of current statements across all accounts and all deals

- Real-time 24/7 access to balances, interest and tax documentation

Solutions for All Your Internal Teams

We know post-closing integration depends on execution that impacts more than just your legal team, which is why we’ve developed tools to support coordination across HR, payroll, finance, tax and other internal stakeholders.

Vesting Schedule Management

We coordinate with your HR, legal and payroll teams to manage founder holdbacks tied to continued employment, removing the typical administrative friction.

Customized Accessibility Across Your Internal Teams

Your portal becomes the definitive source of reference — creating continuity, offering visibility into pending, active and historical deals, with access tailored to each function (legal, tax, treasury, etc.).

Comprehensive Tax Reporting

We handle imputed interest calculations and apply appropriate withholding automatically, lifting the compliance burden from your tax team. Our Employee Compensation Payment Services offering allows us to step in and process payroll for payments to former employees, eliminating the need for you to keep non-employees on your payroll system solely to process post-closing merger consideration.

Deal Support on Israeli-Based Transactions

We coordinate with Israeli trustees and your Israeli counsel, ensuring consistent execution and simplifying an otherwise complex process of acquiring companies with an Israeli nexus.

Online Portal for Securityholders

Our Gateway portal protects sensitive data while collecting documents and payment instructions from securityholders — helping ensure a smooth payout at closing.

Reach a Banker

Contact Our Business Escrow Services Team