FASB Provides Educational Resources to Help Stakeholders Through COVID-19-Related Accounting Issues

A company’s financial statements offer essential information about an organization’s financial health—information that investors and other financial statement users rely on to make capital allocation decisions. Companies and other organizations follow what are known as Generally Accepted Accounting Principles, or GAAP, to provide this important information in their financial reports.

The Financial Accounting Standards Board (FASB) is responsible for developing the standards that constitute GAAP. Since the onset of the COVID-19 pandemic in March 2020, many companies and organizations were faced with unique financial reporting situations brought on by the economic effects of the pandemic. To help stakeholders address the challenges brought on by this unique situation, the FASB has taken a number of steps to help stakeholders understand and apply standards that relate to the unexpected accounting impacts of COVID-19.

Adriana Yepes is supervising project manager with the Financial Accounting Standards Board. Her presentation, “FASB Standards: What You Need to Know Now,” touched on several of the more common accounting issues related to the pandemic. Her presentation is available online and is an excellent resource for information.

Paycheck Protection Program—Accounting-Related Issues

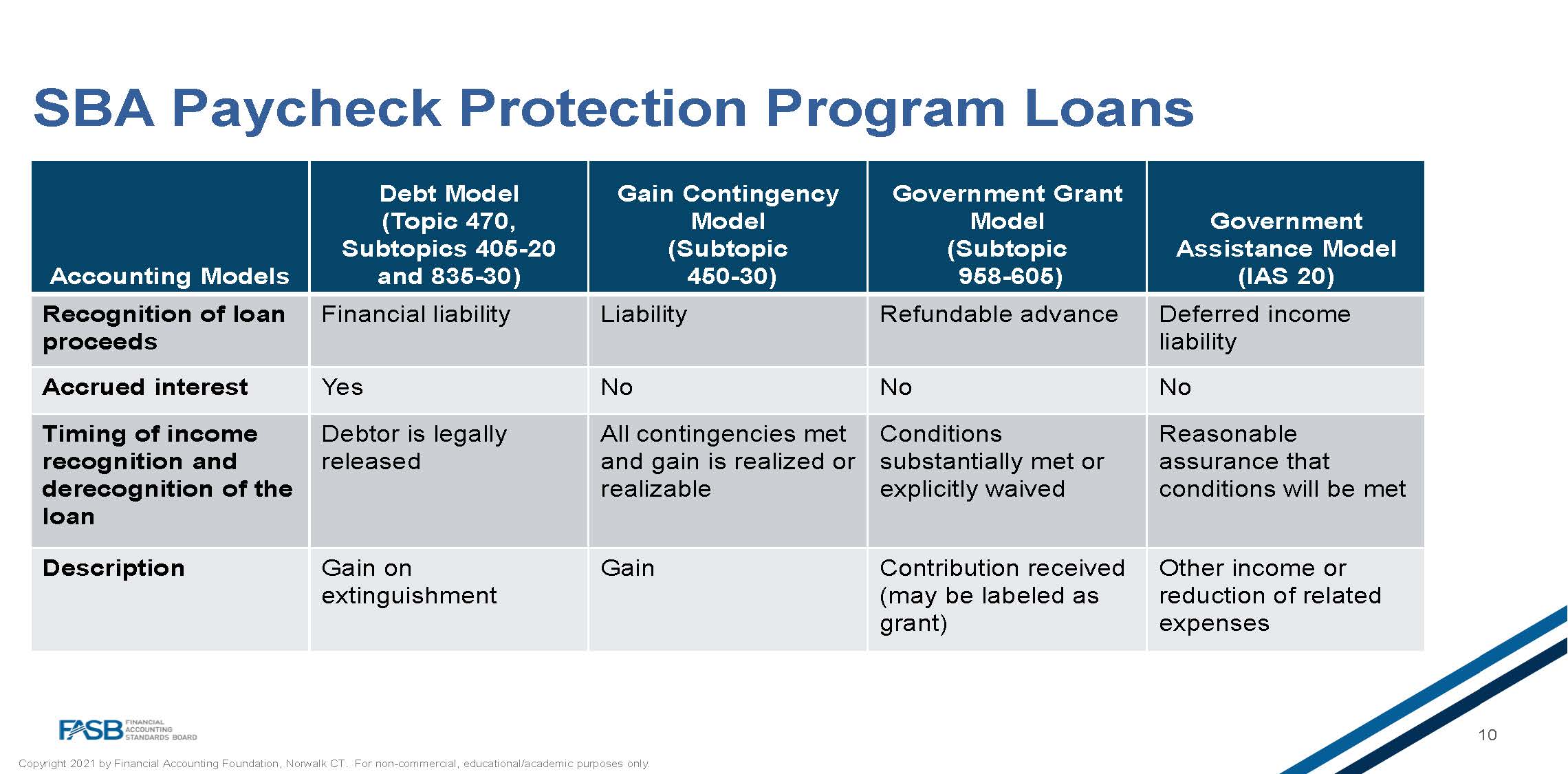

In her summary of accounting by the borrower, Yepes explained that an entity’s structure—for-profit or not-for-profit—will determine which of the four accounting models may be utilized, and how loan proceeds are recognized on financial statements. The chart below is a helpful guide.

Debt Modification

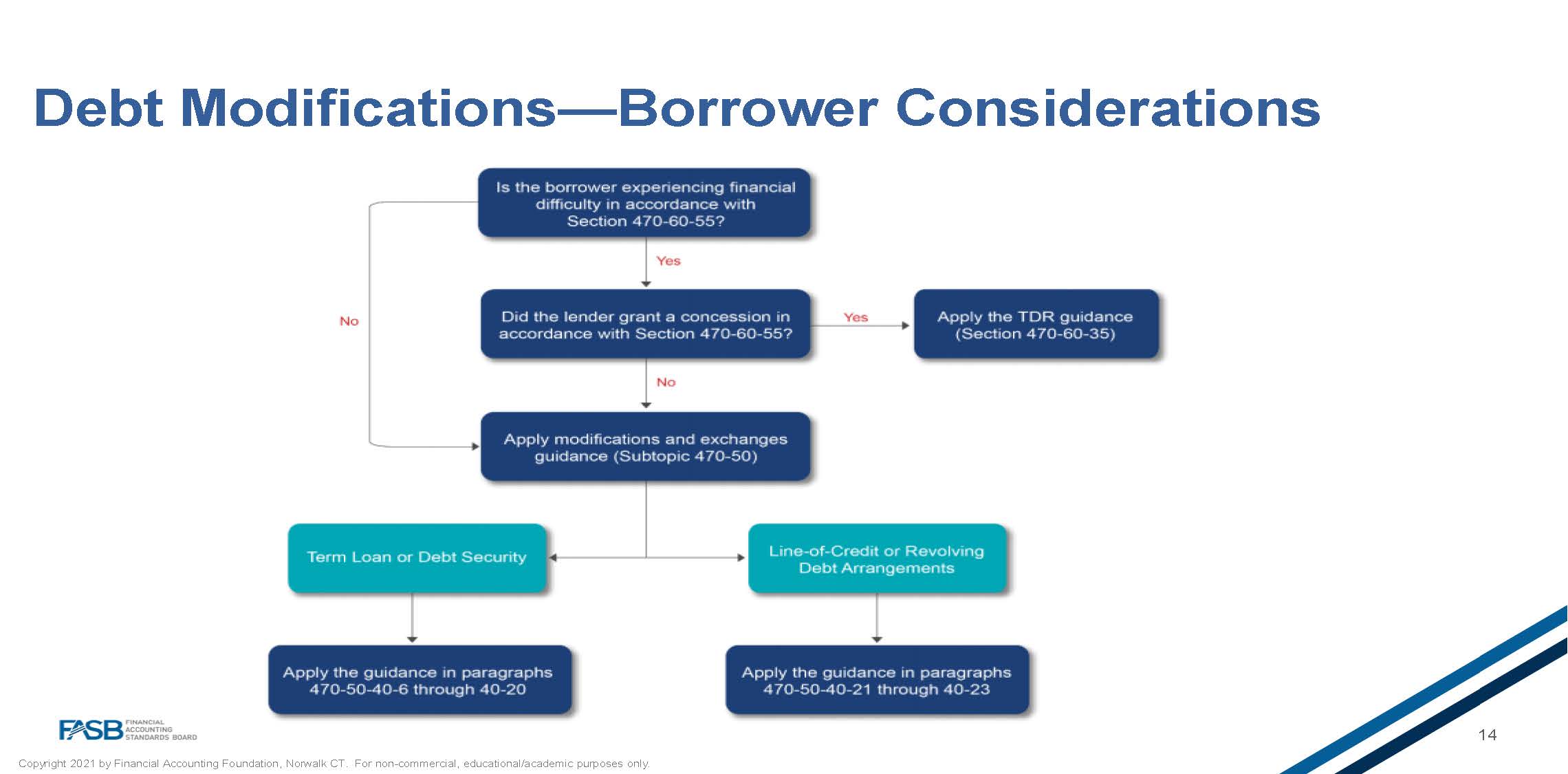

The FASB has received many questions about debt modifications related to the COVID pandemic. According to Yepes, FASB has provided additional guidance on common modifications—from the borrower’s perspective—in Topic 470: How to Account for Debt Modifications.

In short, debt modification can be considered anytime there are changes in debt agreements that result in an entity having to pay out cash flow different from the original arrangement; and the agreement is with the same lender as the original debt. Yepes clarified that changes can include an adjustment in payment timing, changes in interest rates, and maturity date adjustments. If those conditions are met, the next step is to consider whether troubled debt restructuring (TDR) conditions apply, or if the modification and extinguishment guidance is the appropriate option.

Under current FASB guidance, two things must occur to pursue TDR: The borrower must be experiencing financial difficulty, and the lender must have granted the borrower a concession. If these conditions exist, TDR guidance can be found in section 470-60-35.

If those conditions are not met, the modification and extinguishment guidance in 470-50 may apply depending on whether the modification makes the arrangement substantially different from the old arrangement. That determination is generally made with what is referred to as the 10% test.

Lease Concessions

As a result of the pandemic, a significant number of lessors have provided lease concessions to tenants. Concessions can include a deferral of lease payments, cash payments, and a reduction of future lease payments. Due to the high number of businesses affected by concessions, FASB prepared a staff question-and-answer document to clarify guidance which can be found on the fasb.org website. (Topic 842 and Topic 840: Accounting for Lease Concession Related to The Effects of the COVID-19 Pandemic)

As outlined in the presentation by Yepes, FASB staff clarified that an entity would not have to analyze each contract to determine whether it need apply lease modification guidance as long as a) the concession contract does not result in a significant increase in the rights of the lessor, or b) the obligations of the lessee. This is meant to reduce the challenges of evaluating the enforceable right and obligation of each lease contract, which for many companies can be substantial. FASB guidelines do clarify that an entity provide disclosure about the material concession and the accounting of those concessions, and also provide information about the financial effect of those concessions for the end user of the information.

For additional information on the guidelines summarized in this document and other accounting issues related to the COVID pandemic, go to fasb.org/COVID19.

Western Alliance Bank

Western Alliance Bancorporation (NYSE:WAL) is one of the country’s top-performing banking companies. Its primary subsidiary, Western Alliance Bank, Member FDIC, is a leading national bank for business that puts customers first, delivering tailored business banking solutions and consumer products backed by outstanding, personalized service and specific expertise in more than 30 industries and sectors. With $90 billion in assets and offices nationwide, Western Alliance has ranked as a top U.S. bank by American Banker and Bank Director since 2016. In 2025, Western Alliance Bancorporation was #2 for Best CEO, Best CFO and Best Company Board of Directors on Extel’s All-America Executive Team Midcap Banks list.