At Alliance Bank of Arizona, we excel in providing customized financial solutions for businesses through exceptional market- and sector-specific expertise. With a customer-focused approach, our experience and entrepreneurial way of thinking helps clients in all types of industries, professions and business pursuits to meet their unique goals.

Commercial Real Estate & Construction

We've built a bank that's right for real estate and construction companies, so you can keep building your business.

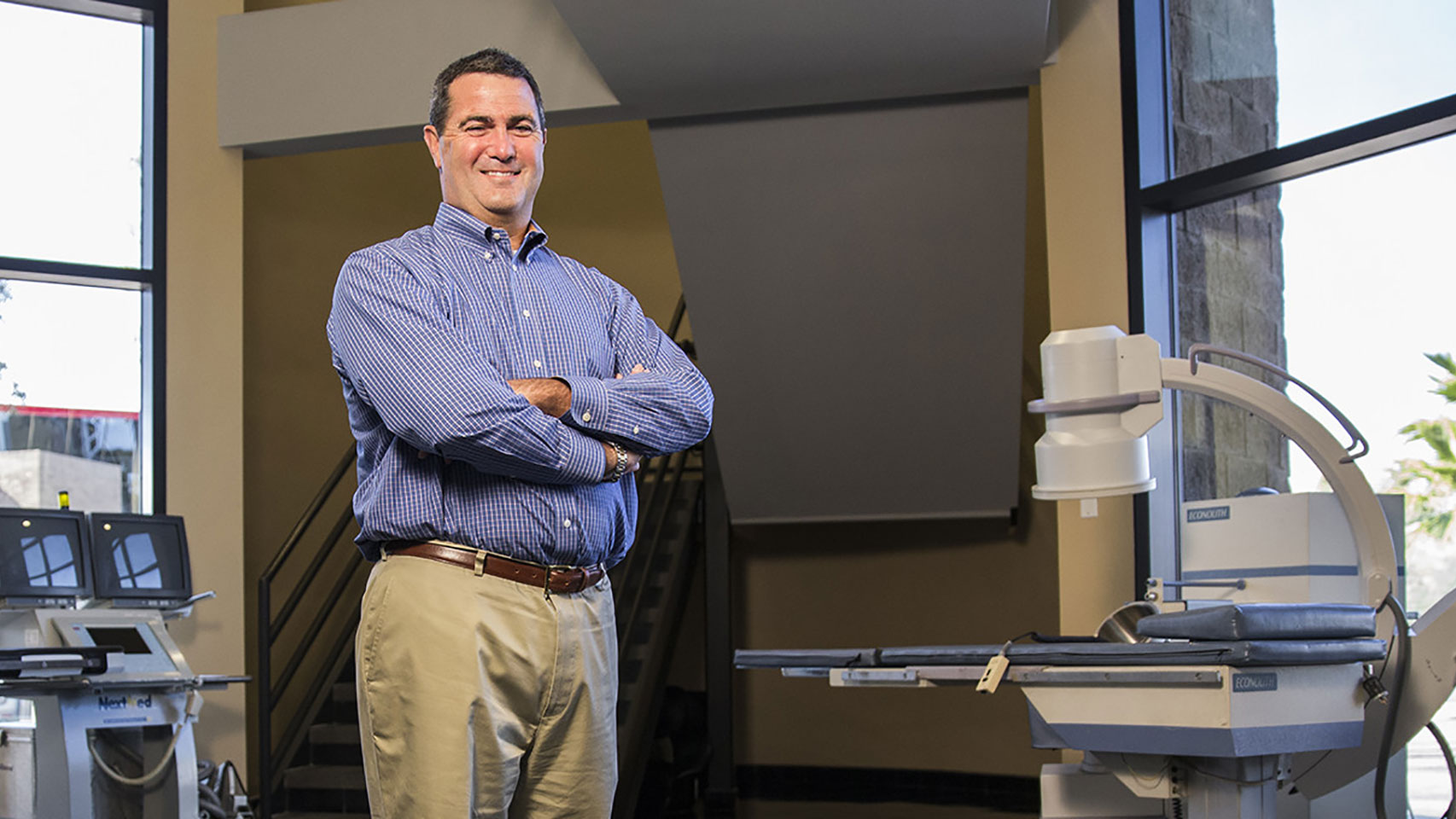

Healthcare

Making the most of changing healthcare dynamics is your expertise. Work with our knowledgeable bankers who understand this complex industry.

Hotels

As a leader in hotel lending, our Hotel Franchise Finance group specializes in meeting the growth and expansion needs of the hospitality industry from the ground up.

Legal

Your clients depend on you for expert counsel. Depend on us for specialized banking products and high-value relationships for the legal profession.

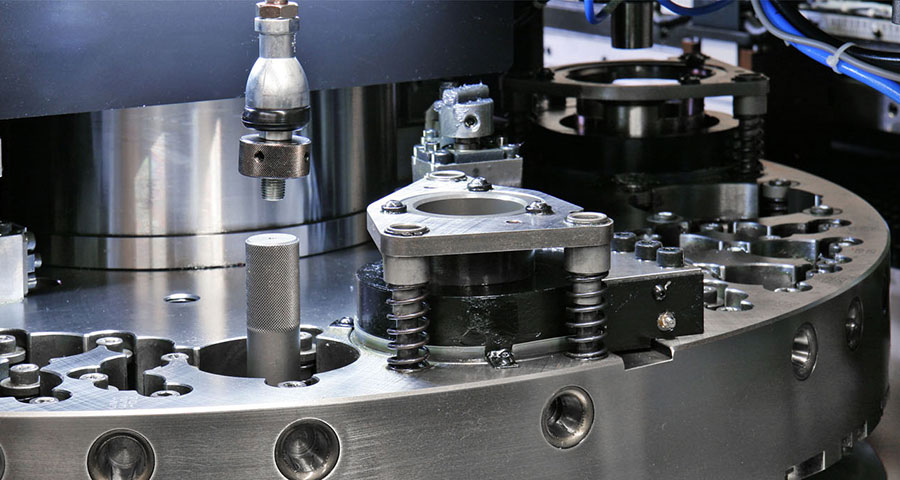

Manufacturing & Logistics

You understand supply and demand. When it comes to smart banking and financing for manufacturers and distributers, we do too.

Municipal & Local Government

We are a strong resource for municipalities and local governments that need specialized project financing (and always efficient everyday banking).

Nonprofits

Connect with committed, knowledgeable bankers who understand and support the nonprofits that make our communities better.

Professional Services

Taking care of clients, patients and customers is what you do – taking care of your banking and financing needs is what we do.

Restaurants

Our Franchise Finance group delivers a full spectrum of customized loan, deposit and treasury management solutions to restaurant operators and franchisees in quick-service restaurants (QSR), fast-casual, casual and chains across the nation.

Timeshare Resorts

Great experiences start with you. Great banking and financing solutions for the hospitality and tourism industries start with us.